Hey Compliance Warriors!

In California employees can be entitled to pay for time they haven’t even worked. Here’s some interesting information on how Split-shift” pay works and how to report it. Read on…

Article via: www.mondaq.com

“Your head is already spinning if you’ve wrapped it around California’s quirky wage and hour laws. It may explode when you consider the notion of having to pay for time not worked. The duties to pay split-shift and reporting-time premiums are not new, but don’t worry: you’re not alone if you haven’t heard of them. Reading this piece will deepen your appreciation of just how peculiar California can be!

Split Shift Pay

What is it? Split-shift pay is governed by the Wage Orders (generally Section 4(C)). A split shift occurs when (1) a work schedule includes a block of unpaid time that is longer than 60 minutes (that is not a meal period) in a workday, (2) the block of time interrupts two work periods, and (3) the total daily wage does not exceed the minimum wage for all hours worked, plus one additional hour. The idea behind requiring split-shift pay is that the employee is not really free of duty between shifts because of the looming shift later in the day.

When a split shift occurs, employers must pay a premium of one hour of pay (unless the break qualifies as a “bona fide” rest or meal period).

What’s an example? For an eight-hour workday, the employer schedules a first shift from 9:00 a.m. to 1:00 p.m., and a second shift from 3:00 p.m. to 7:00 p.m.

How is the premium calculated? The split-shift premium generally would be an hour of pay at the minimum wage.

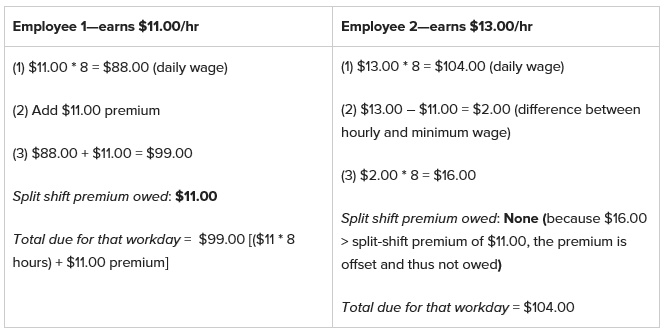

But it can get tricky. If the hourly wage exceeds the minimum wage, a split-shift premium may not be due. To see if one is due, you multiply the difference in rate (between the hourly wage and the minimum wage) by the hours worked that day. If the product of those numbers exceeds the split-shift premium (one hour at minimum wage), then the split shift premium is offset and not owed.

Suppose that two employees of a large employer both work the split shift described in our example. One employee makes the 2018 California minimum wage: $11.00. The other employee’s wage is $13.00. Here are the calculations:

Nuance: While split-shift payments are considered wages, they need not be included in the regular rate when calculating overtime pay.

A strange split-shift issue can arise if an employee’s work crosses the defined workday. Consider a night-shift employee subject to a typical workday starting at midnight who works at minimum wage from 12:01 a.m. to 4:00 a.m. and then again from 10:00 p.m. to 4:00 a.m. That employee would be entitled to a split-shift premium, because of the long block of time separating work shifts within the same workday. The result would differ, however, had the workday been defined to start at 9:00 p.m. In that case, the employee would not experience a block of time separating work shifts during the same workday. An employer can redefine the workday for a group of employees so long as the workday definition is not a temporary means to avoid overtime.

Reporting Time Pay

What is it? Reporting-time pay is governed by the Wage Orders (Section 5). When an employee reports to work at the regularly scheduled time, but then gets sent home (usually for lack of work), the employer must pay for at least one-half the scheduled hours, at the regular rate. In no case, however, is the employee entitled to less than two hours of pay or to more than four. Here, the idea is that the employee who honored the employer’s schedule, expecting to work, should be compensated for the lack of work.

What are some examples?

Employee 1 is scheduled for an eight-hour shift, but then gets sent home after working just one hour. The employer must pay four hours at the regular rate-one for the hour worked and three more for reporting time because four hours is one-half of the scheduled eight hours of work. Note that only the one hour actually worked, however, would count as hours worked for purposes of determining eligibility for weekly overtime pay.

Employee 2 is scheduled to report to work a second time in a workday, but then gets furnished less than two hours of work. The employer still must pay for two hours at the regular rate.

The DLSE has identified certain exceptions to reporting-pay rules, applying when

operations cannot begin or continue because of threats to employees or property, or when civil authorities recommend that work not begin or continue;

public utilities fail to supply electricity, water, or gas, or there is a failure in the public utilities, or sewer system; or

the interruption of work results from a cause beyond the employer’s control (such as an earthquake).

Nuance: The reporting-time pay provisions do not apply to employees on paid standby status, or to employees who have a regularly scheduled shift of less than two hours, such as a relief cashier who works a one-hour shift in the middle of the day.

Workplace Solutions

Employers should carefully review their practices to ensure that they adequately pay employees on split shifts. Employers should also be sure to incorporate reporting-time pay requirements into their policies. Doing this can avoid an obligation to pay back wages and penalties.”

For more information visit: http://www.mondaq.com/californiasplishiftpay

Until Next Time, Be Audit Secure!

Lisa Smith